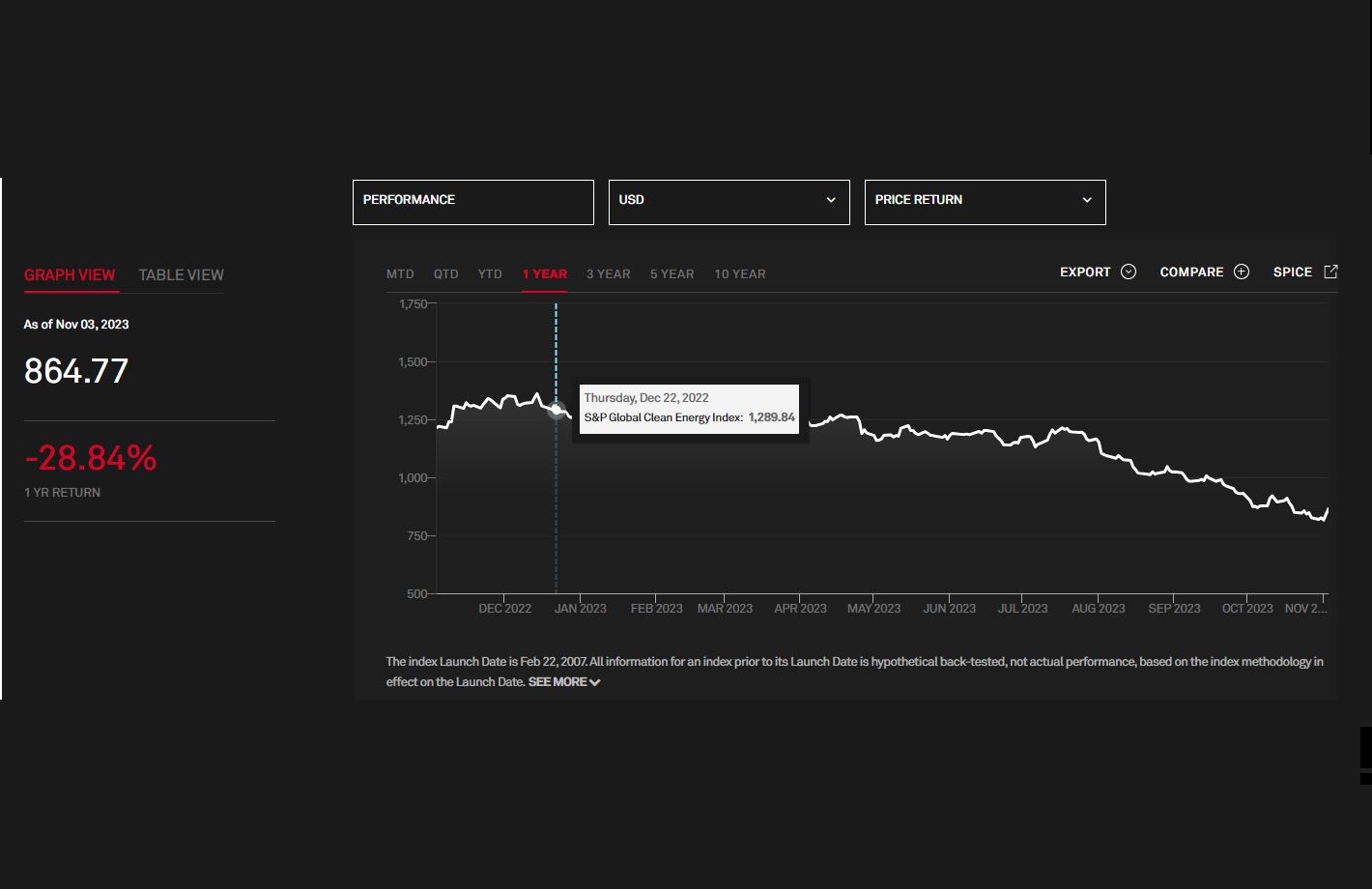

How strong was the impact of rising interest rates on the renewable energy sector? A lot, if we look at the S&P Global Clean Energy index.

The index consists of the major companies in the renewable energy sector – not only folks likes of First Solar, Vestas and Ørsted (formerly Dong Energy), but also Chinese companies such as China Yangtze Power (the Chinese weigh in at 15% of the index, second only to the Americans).

In one year it lost almost 30% of its value. The S&P 500 until now (October 2023) has fared much better, although it has been notoriously pulled by a few companies. It would also appear that investors have started withdrawing capital from specialised funds, such as the iShares Global Clean Energy ETF.

One of the problems is the effect of rising interest rates on companies in the renewable energy sector.

Wind (and solar) projects are usually financed with a large percentage of debt. A ‘normal’ capital structure is in the order of magnitude 30% equity / 70% debt.

In practice, a significant amount of capital needs to be invested, for returns that will materialise over the next 25-30 years.

This investment model is obviously different from a ‘traditional’ project: for example, a coal-fired power plant has a lower initial investment (CapEx) and proportionately higher operating expenses (OpEx) compared to a wind farm.

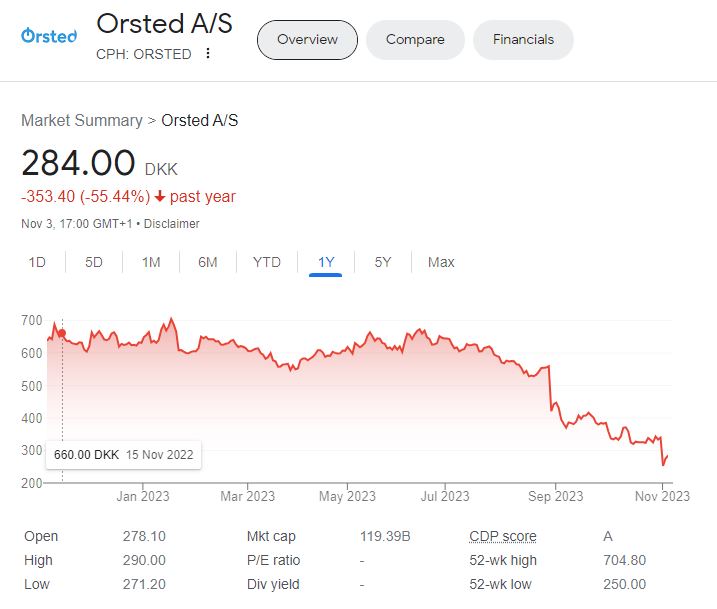

When interest rates are high, getting into debt is more expensive. Renewable projects become less profitable – or stop being sensible investments, as the offshore projects cancelled by Vattenfall, Iberdrola and Ørsted would seem to indicate.

Vattenfal cancelled the Norfolk Boreas offshore wind project, off the coast of Britain. Ørsted cancelled 2 offshore projects in New Jersey, Ocean Wind 1 and Ocean Wind 2. Expected impact could be over 5 billion.

One of the key metrics to consider in this discussion is WACC, which stands for Weighted Average Cost of Capital.

It is a financial metric used to evaluate the cost of financing a company’s operations and investments.

It represents the average rate of return a company needs to pay to its investors and lenders for the capital they have provided to the company.

The formula for calculating the WACC is:

WACC = (We * Re) + (Wd * Rd) * (1 – T)

where

Weight of Equity (We): This is the proportion of the project capital structure represented by equity.

Cost of Equity (Re): This is the expected return demanded by shareholders for investing in the project. It’s often calculated using models like the Capital Asset Pricing Model (CAPM), dividend discount model, or other methods.

Weight of Debt (Wd): This is the proportion of the project’s capital structure represented by debt.

Cost of Debt (Rd): This represents the interest rate or yield a company pays on its debt. It can be determined by looking at the interest rates on bonds, loans, or other forms of debt.

Tax Rate (T): The corporate tax rate, as it affects the cost of debt. Interest payments on debt are typically tax-deductible, which can lower the effective cost of debt.

In this formula, the cost of equity (Re) and the cost of debt (Rd) are weighted by the respective proportions of equity (We) and debt (Wd) in the company’s capital structure. The tax rate (T) is subtracted from the cost of debt to reflect the tax advantages of debt financing.

The Weighted Average Cost of Capital (WACC) is highly relevant in renewable energy projects. Calculating the WACC helps project developers and investors estimate the overall cost of the capital needed to finance the project.

If the project’s expected return is higher than the WACC, it suggests that the project may generate a positive net present value (NPV) and is financially viable.

WACC can also help determine the optimal capital structure. A lower WACC may encourage greater use of debt, while a higher WACC may necessitate a higher proportion of equity.

The rise of interest rates is pushing up WACC: When the Fed (or ECB, or Bank of England) hikes interest rates, the risk-free rate immediately increases, which raises the company’s WACC.

This is obviously not a new problem: the business model of renewable projects has been the same for the last decades.

Unfortunately, it is combined with the effects of inflation: companies in the sector close contracts for projects that they have to realise in the following years, and are exposed to abrupt market movements.

For example, a turbine manufacturer may close a contract to deliver turbines 1 or 2 years later. In the meantime, due to the war in Ukraine, Covid or some other unexpected event, the price of steel may increase by 20%: it will be difficult to pass these increases on to the end customer.

Developers of wind farms are in a similar situation: they sign contracts to sell energy at a fixed price for the next 20 years, but the cost of realising the project may increase significantly, leading to a loss on the investment.

In addition to the problem of inflation, supply chain disruptions and interest rate increases, some companies are also experiencing further difficulties.

Siemens Energy, which controls the turbine manufacturer Gamesa, announced quality problems for which they expect expenses of EUR 1.6 billion (and a net loss of EUR 4.5 billion for 2023).

Below is a Deutsche Welle video on the subject.

I feel I agree with Mr. Fuest’s position (I see that the full title is Prof. Dr. Dr. h.c. Clemens Fuest).

For Siemens Energy, too, the market did not welcome the news.

Siemens Energy and Orsted are in good company: other companies that have reported significant losses in the past year include Nextera Energy Partners (-60%) and AES Corporation (-30%).

Leave a Reply