So, how good is the wind farm you are working at?

There are several parameters that can be used to assess a renewable energy project and to compare different projects.

Among the most used, it is worth mentioning the Capacity Factor, NPV, IRR and LCOE.

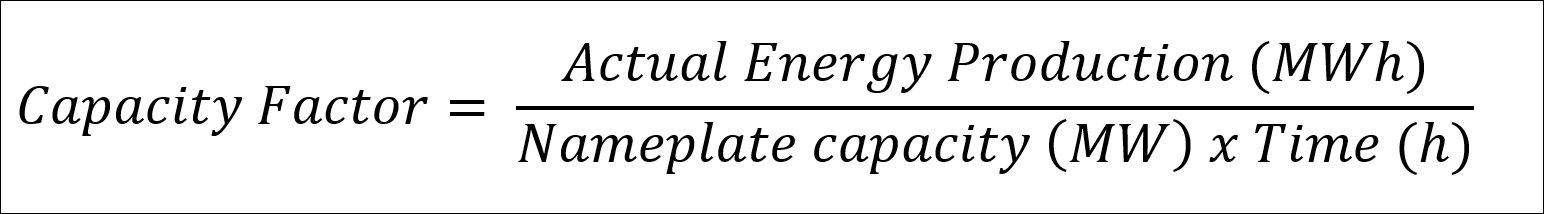

Capacity Factor is the ratio between the actual energy production of the wind farm (that is, GWh/year) compared with the theoretical production.

Expressed as a percentage it is usually a number somewhere between 20% and 50%. Wind farm with a capacity factor above 50% are usually regarded as quite exceptional.

Expressed as a percentage it is usually a number somewhere between 20% and 50%. Wind farm with a capacity factor above 50% are usually regarded as quite exceptional.

It is basically function of two parameters, wind variability and wind turbine selected for the project. On top of that you will have several losses – for instance electrical losses, noise curtailment, wake losses, etc.

To calculate it you will simply divide the energy produced by the wind farm by the nameplate capacity by the number of hours. Due to the seasonal variability of the wind it makes sense to make an yearly calculation.

What is interesting is that Capacity Factor is fundamentally and economical decision. At the end of the day you want to improve your business case, so it could make sense to install wind turbines giving a lower capacity factor (but with an even lower total cost).

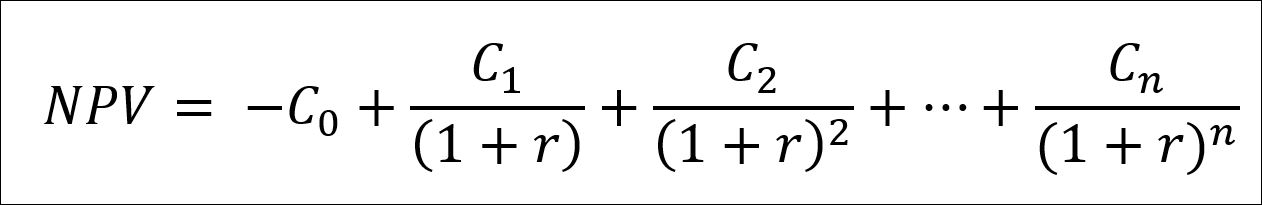

The Net Present Value (NPV) is today’s value of a future cash flow.

In the formula C is the cash flow (-C0 is the initial investment, C1 is the cash flow of the first year and so on until the last year, n) and r is the discount rate.

In the formula C is the cash flow (-C0 is the initial investment, C1 is the cash flow of the first year and so on until the last year, n) and r is the discount rate.

This metrics give priority to the absolute return of the investment. Basically it is useful if you have only one shot: if you put all your money in a single project you will prefer (ceteris paribus) the one bringing more money.

The discount rate reflect the fact that money in the future is worth less than money today – for inflation, cost of opportunity, etc.

Internal Rate of Return (IRR) is the discount rate that makes NPV = 0.

This metrics give priority to the percentage return. It could be useful for instance if you can pick several projects among many.

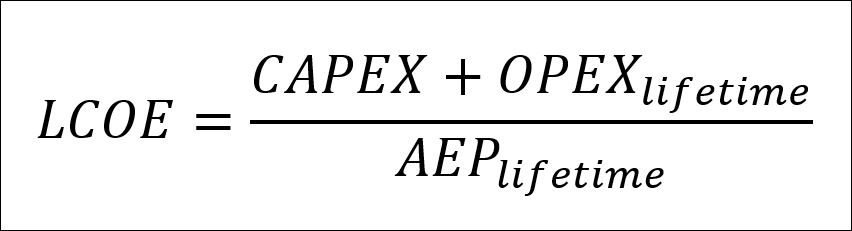

Levelized Cost of Energy (LCOE) is defined as (CAPEX + OPEX ) / AEP

CAPEX (Capital Expenditure) is the money that the wind farm developer will have to put in all the assets – not only the wind turbine itself but also the infrastructure (roads, foundations, substation, etc.), and the development costs (everything from land lease agreements to the engineering studies).

OPEX (Operational Expenditure) is what the wind farm owner will spend to have the wind farm up and running.

This include basically the maintenance of the wind turbines (they need new oil every now and then, pretty much like your car) and of the substation equipment. As the lifetime of such project is increasing from what used to be industry standard (20 years) to 25, 30 years and more.

Additionally the more the wind turbine gets older the more is likely that it would need major maintenance (for instance a new gear box).

LCOE makes a lot of sense when you are trying to compare energy produced by different technologies, for instance wind and solar photovoltaic.

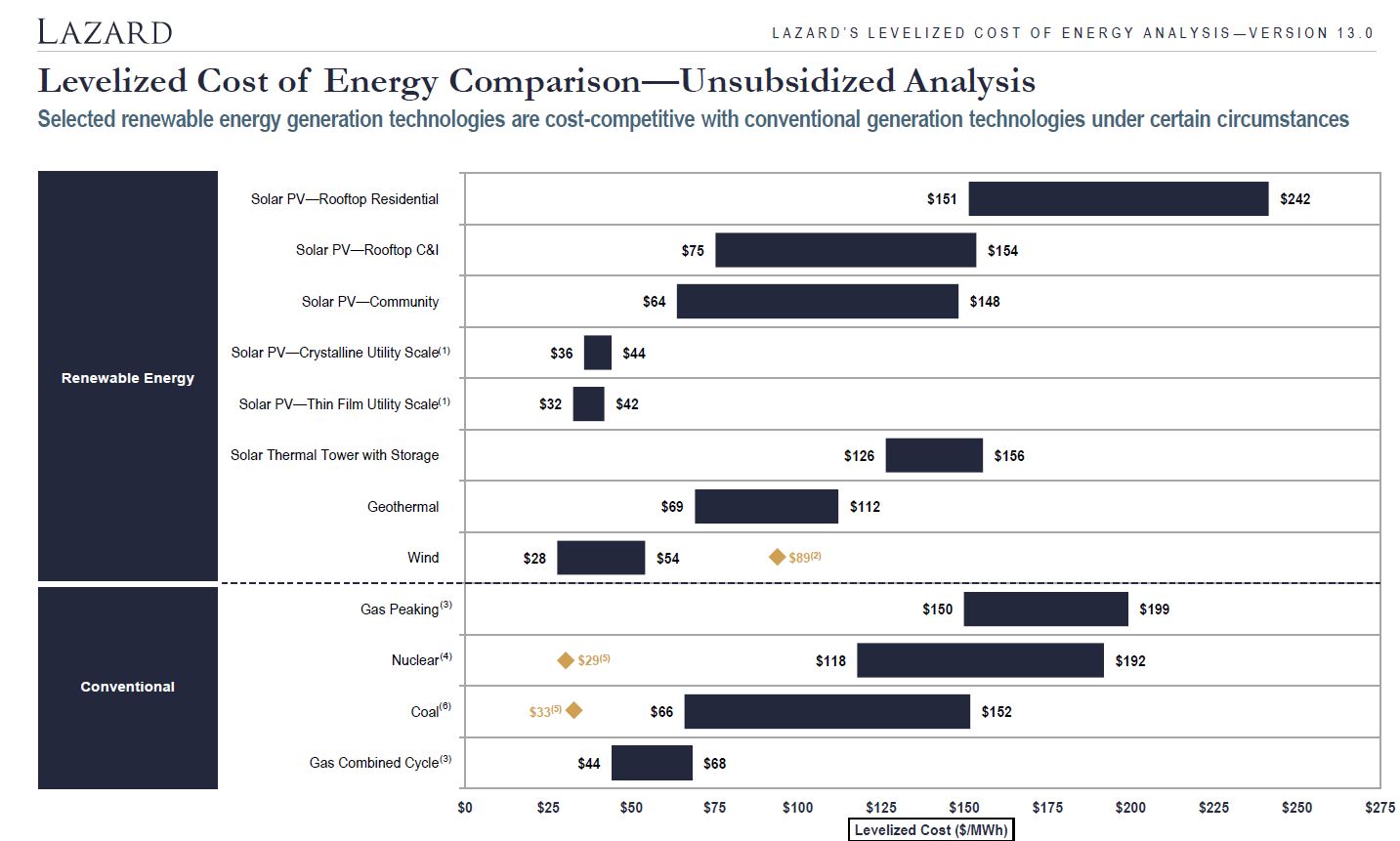

Lazard (a huge private investment bank and financial advisory firm) distribute periodically a study on the evolution of LCOE. Currently available in version 13 it gives you some visibility on how much different forms of energy cost without subsidies.

I still remember when I started working in the renewables sectors about 10 years ago. Comparing the cost of solar and wind I believed that my colleagues who decided to work in solar were crazy as the cost per MWh of Solar PV was huge.

Well, it looks like I was wrong.

Leave a Reply