Author: Francesco Miceli

-

Wind farm internal roads optimization

In parallel with the optimization of crane pads (you can find the article on the topic here) I am also trying to automate the calculation of wind farm internal roads. At the moment I have developed three solutions: the first joins the turbines looking for the minimum spanning tree (MST), i.e., the shortest possible connection….

-

BoP –> Sourcing

And so, after 15 years of BoP, I decided to start a new chapter and move to Sourcing. I think I will be able to update the blog from time to time thanks to friends and colleagues who are still in BoP. If you happen to have experience in the field and would like to…

-

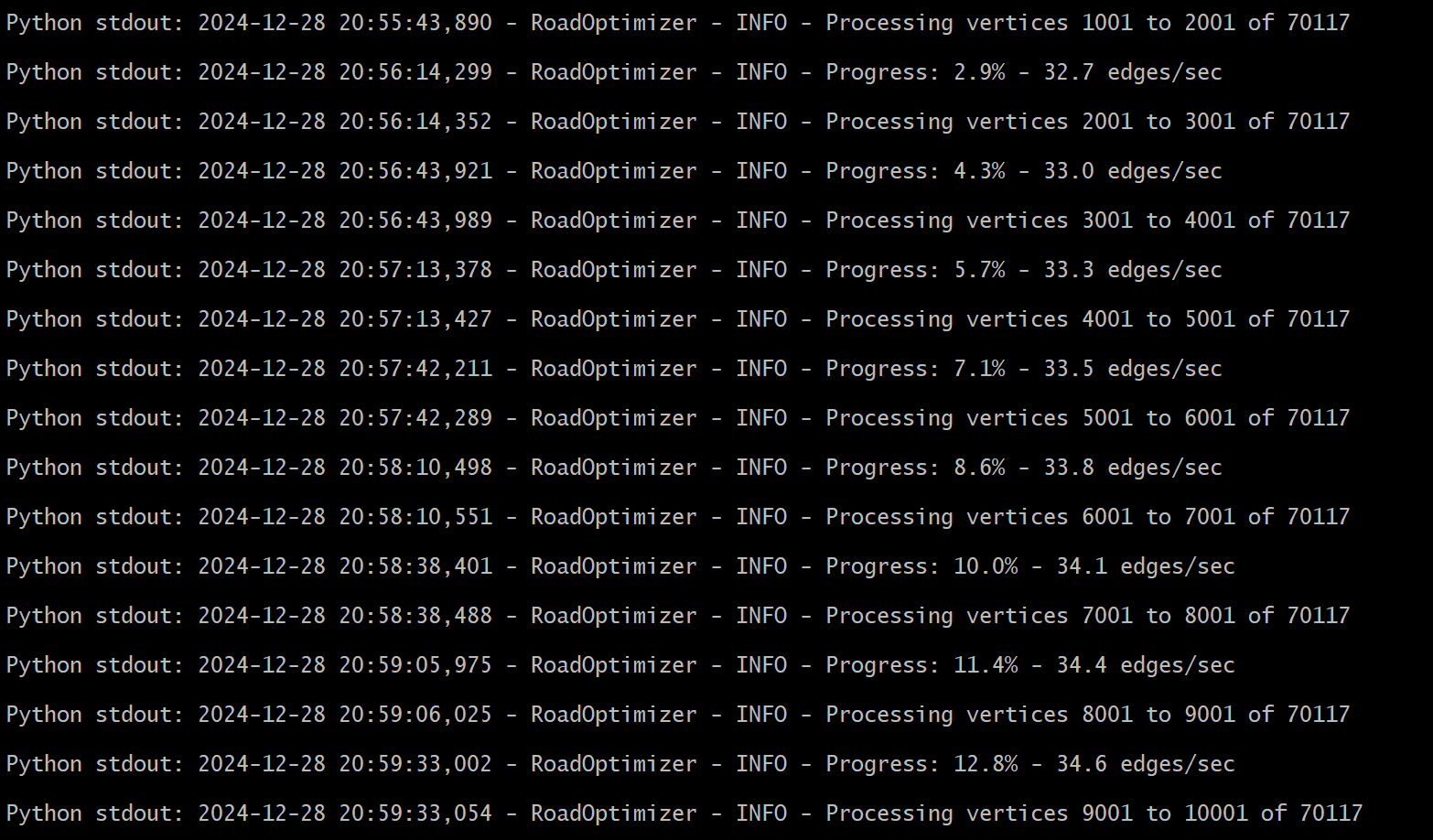

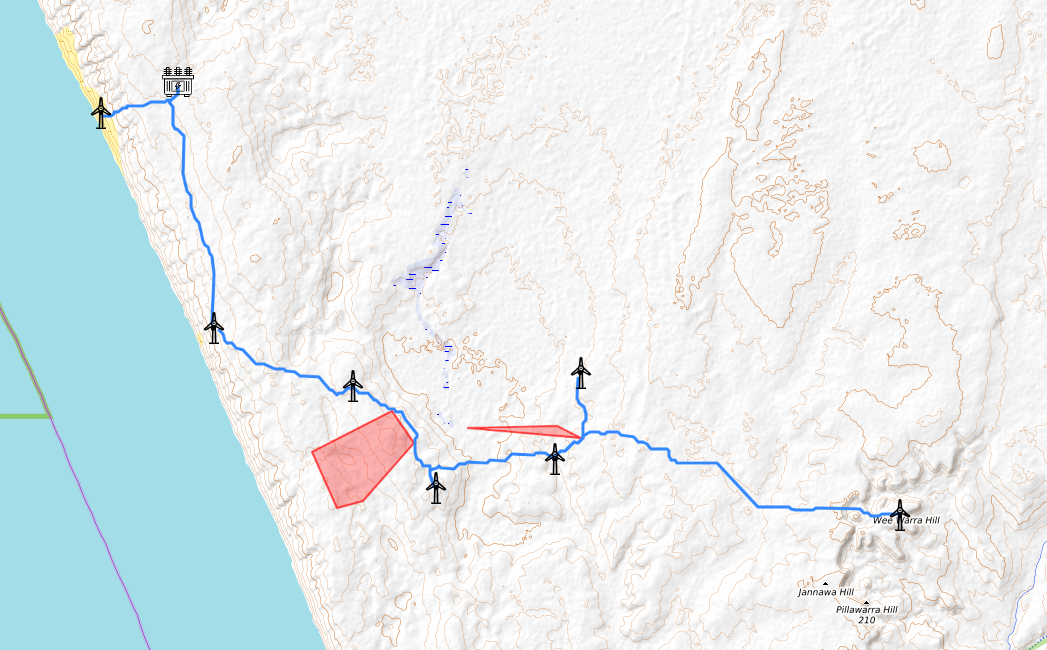

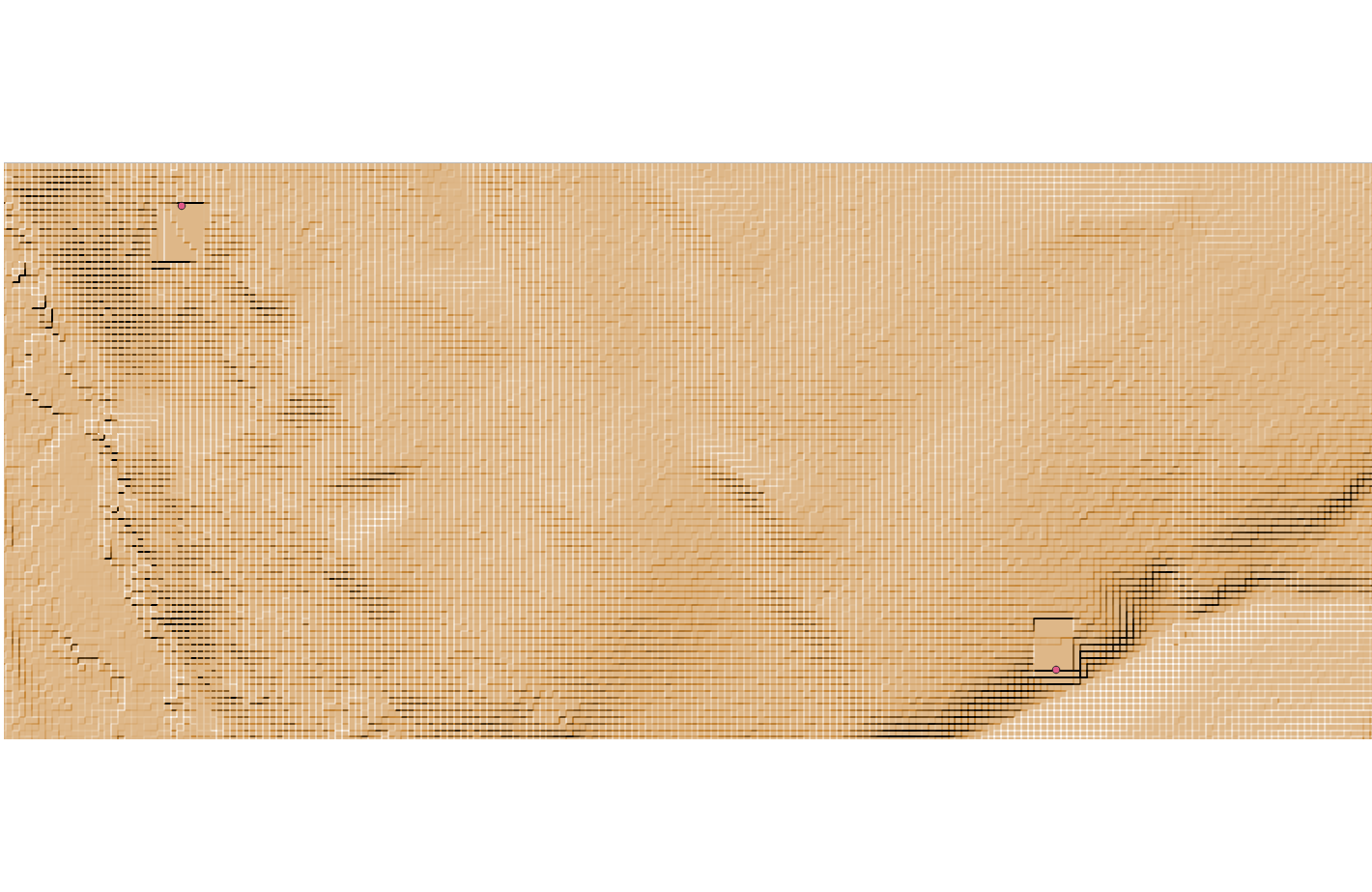

Internal roads optimization: an update

These vacation days I am managing to find time to work on my “automatic wind farm optimization” project.Yesterday I managed to add a new feature to the optimization of wind farm internal roads.In the new version, the algorithm is also able to consider existing roads and “no-go-areas” (areas that cannot be used due to environmental…

-

Dobberzin WF

The photos below, stolen from LinkedIn, are from one of the last tenders I worked on. It is of the Dobberzin wind farm, with the Nordex concrete tower installed. Interesting to note how the keystones are assembled and joined together by grouting.

-

Wind farm crane pads optimization: a solution with QGIS

QGIS is a great open source GIS software that I often use to display information in various formats (e.g. SHP). It has an interesting number of additional plug-ins that enhance its capabilities. Over this Christmas break I managed to find a few hours and have virtually finished developing a plug in that helps define the…

-

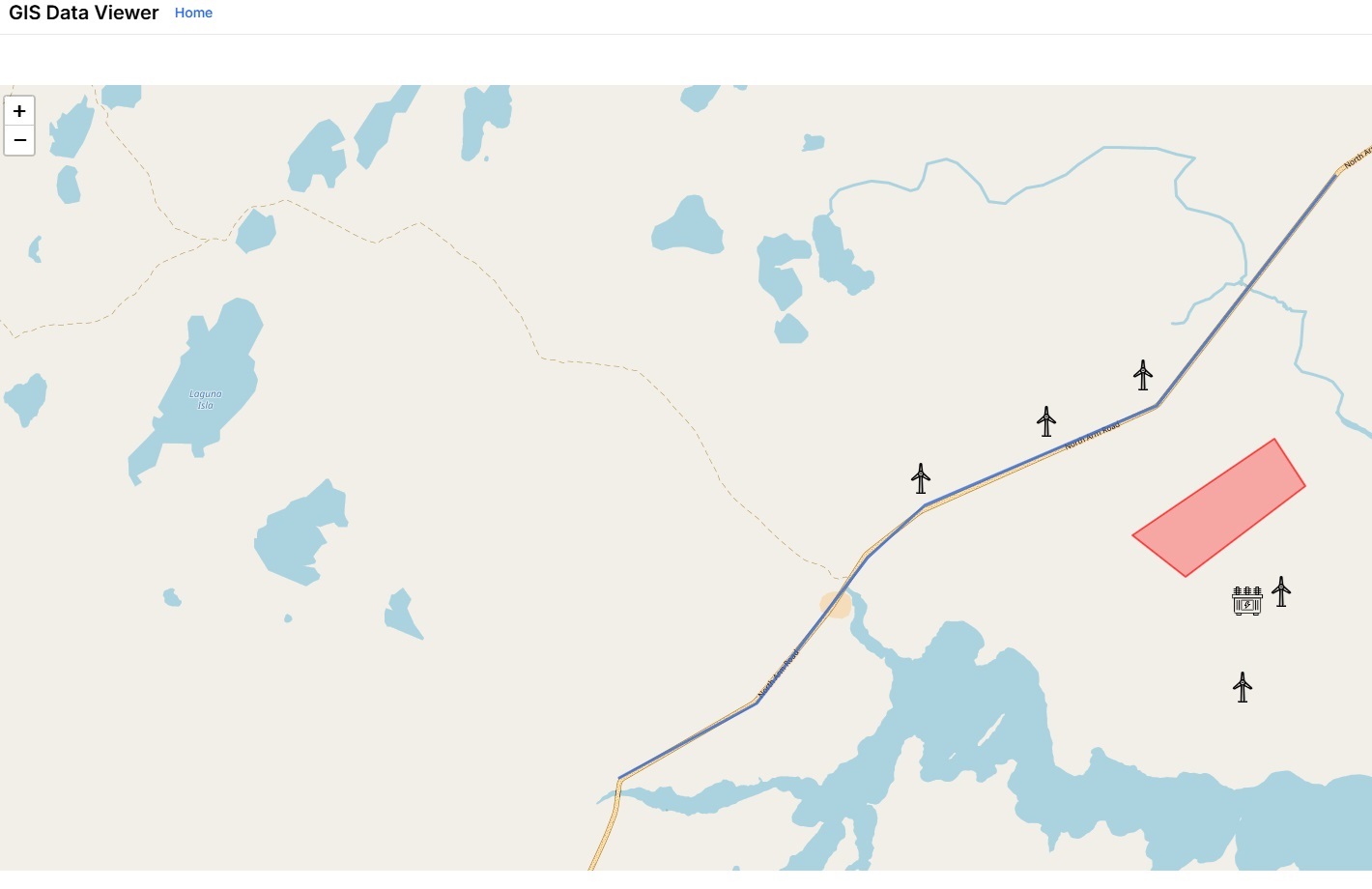

Wind farm BoP optimizer

After several years pondering the possibility, I finally decided to try to build an app that automatically optimizes the BoP of wind farms. So, with the help of relatives who kept their children busy during the Christmas vacations and Claud.ia (Anthropic’s artificial intelligence) I began to complete the various elements. The idea is to solve…

-

Lomas de Taltal

Another interesting video, again stolen on LinkedIn. It is about the wind farm developed by Goldwin in Taltal (the official name I believe is ‘Lomas de Taltal’). The area is especially interesting since it is one of the most extreme deserts in the world – we are in northern Chile, between Atacama and Antofagasta. If…

-

BoP cost in China

I stole this video from Gang Wang’s LinkedIn post. I saw in his profile that we were colleagues at Vestas years ago. A typical 20x5MW-191 HH160 hybrid ONWTG 100MW project’s CAPEX breakdown in CN mid-east low wind speed area: WTG: 1,600 RMB/kWHybrid Tower: 800 RMB/kWBOP: 1,400-1,800 RMB/kW The video is especially interesting for two reasons:…

-

Esteyco’s braced foundation: an update

This article is an update to the post I have made some time ago on Esteyco’s Braced Foundation. I have been contacted by David Sarrasín, Product Development Director at Esteyco. He provided an interesting presentation of the braced foundation solution. He also gave me more context on the solution. This is the additional info he…

-

Transporting wind turbine blades: when something goes wrong

A collection of videos featuring the transportation of wind turbine blades – some truly impressive.